how long does coverage normally remain on a limited-pay life policy

If you are thirty years old and purchase a twenty year policy then the premium and life coverage will last until you are 50 years old. Annual renewable term This gives you coverage for one year with the option of renewing it each year for a specified duration such as 20 years.

What Is Whole Life Insurance Cost Types Faqs

Frequently these limitations are based on the type of medical condition that is disabling you.

. A limited pay whole life policy is a permanent insurance policy guaranteed to be fully paid-up at a certain date or when you reach a certain age with no more premiums due. How long does the coverage normally remain on a limited-pay life policy. You shouldnt skip long term disability insurance coverage in lieu of having just a short-term policy.

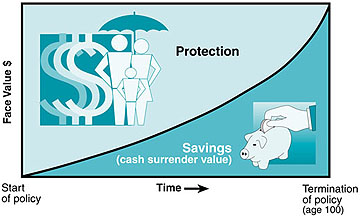

Limited pay policies are sometimes referred to as 10-pay 15-pay or 20-pay life depending upon the number of years premiums are to be paid. With a modified premium whole life insurance contract the amount of premium due is lower in the first years of the policy. Limited pay life insurance is a type of whole life insurance policy that is structured to only owe premiums for a set number of years.

A Limited-Pay Life policy has. Short term coverage will not be adequate in the event you suffer a serious injury or illness. This policy lets you pay premiums for only a specific period such as 20 years or until age 65 but insures you for your whole life.

Most insurance companies will issue the death benefit within two weeks of the policyholders death. If G were to die at age 50 how long would Gs family receive an income. That can be anywhere from 20 to 30 years if you plan to support past the age of 18.

1 7 14 30 days. In most cases whole life policies pay a tax-free death benefit to beneficiaries when the insured dies. Coverage however remains in force for the insureds lifetime.

Premiums are payable for as long as there is insurance coverage in force. This is pretty simple to explain. What kind of premium does a Whole Life policy have.

Paid Until Age 65. But on average how long does it take for life insurance to be distributed. How long does the coverage normally remain on a limited-pay life policy.

Term life insurance coverage lasts for a limited period of time. If coverage lapses the insurance company will refund part of the premium payments andor pay the policys cash value. Fewer than 60 days have passed since your hospital stay in June so youre in the same benefit period.

Limited payment whole life insurance. As a general rule of thumb fewer years results in a higher annual premium. Life Paid-Up at Age 70.

Also the shorter the pay period the more faster you will accumulate cash value. Unlike term life insurance which is meant for a specific period such as 20 years universal life insurance is in effect for the rest of your. Age 100 20 A term life insurance policy matures upon the insureds death during the term of the policy Decks in Insurance Class 3.

Premiums are payable for as long as there is insurance coverage in force. For example many LTD policies limit benefits for mental health conditions to 1224 months. The amount of coverage on a group credit life policy is limited to.

How long does the coverage normally remain on a limited-pay life policy. A limited pay policy is whole life insurance that requires premiums only for a specified number of years or to a specified age of the insured. With the limited pay life insurance option you pay premiums in the early years of ownership but the benefits.

Your policy may also have a non-verifiable symptom limitation. 1 2 5 10 years. Age 100 What kind of life policy either pays the face value upon the death.

The amount of coverage on a group credit life policy is limited to. 30 60 90 180 365 days. Which of these would be considered a Limited-Pay Life policy.

Continue paying Part A deductible if you havent paid the entire amount No coinsurance for first 60 days. 60-80 of income. To age 65 or 67.

With some policies coverage will not lapse in case of non-payment. With this policy your rates go up every year that you renew and are calculated based on. Single premium whole life insurance.

10-year Renewable and Convertible Term Life Paid-Up at Age 70 Straight Whole Life Renewable Term to Age 100. How long does the coverage normally remain on a limited-pay life policy. As a result premium payments will be higher than if payments were spread out through your lifetime.

The insureds total loan value. You may have to wait up to 30 days for a payout but you will usually receive it much sooner. In the SNF continue paying the Part A deductible until its fully paid.

For example a 500k 10 year limited pay whole life insurance policy will cost more than a 500k 20 year policy. This is the main reason that term insurance is far less expensive than whole and universal life insurance. This period of lower premiums usually lasts through the first five to ten years of a policys life depending upon.

Older people may be restricted to 10- or 20-year terms especially once they reach their 60s and 70s. In a traditional whole life insurance policy premium payments are flat throughout the life of a policy. Instead the policy will remain in place but with a reduced death benefit calculated as a percentage of the premiums that were paid.

The insureds total loan value. In other words rather than paying your insurance premiums in perpetuity you agree to pay them in full over a pre-specified time. Term length limits can also impact how much coverage you get regardless of how much life insurance you need and can afford.

What Is Limited Pay Life Insurance Paradigm Life Insurance

What Is Limited Pay Life Insurance Paradigm Life Insurance

Life Insurance Purposes And Basic Policies Mu Extension

/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Term Vs Universal Life Insurance What S The Difference

Guaranteed Issue Life Insurance Policies Fidelity Life

Types Of Life Insurance Explained Progressive

2022 Final Expense Insurance Guide Costs For Seniors

What Is Term Life Insurance Money

Aaa Life Insurance Review No Exam Policies And Discounts Valuepenguin

What Is Limited Pay Life Insurance Paradigm Life Insurance

How Does Life Insurance Work Forbes Advisor

Guaranteed Issue Life Insurance Policies Fidelity Life

Guaranteed Issue Life Insurance Policies Fidelity Life

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference